About 'mortgage debts'|Expiration of Debt Relief Act Could Revive Mortgage Crisis

According to a press release from the Hillary Clinton campaign on March 24, in a major speech in Philadelphia, Hillary Clinton announced a specific four-point plan that she believes will stem the tide of home foreclosures - a key driver in the currently weakening economy. "Over the past week, we've seen unprecedented action to maintain confidence in our credit markets and head off a crisis for Wall Street Banks," Clinton said. "It's now time for equally aggressive action to help families avoid foreclosure and keep communities accross this country from spiraling into recession," said Clinton. "The solution I've proposed is a sensible way for everyone - lenders, investors, mortgage companies and borrowers - to share responsibility, keep families in their homes, and stabilize our communities and our economy." Whether her plan will work can be determined by lining it up with the sort of problems consumers are currently facing in the real world. Our Mortgage Crisis In 2003, my wife and I, and our two young children, moved into our first home in southern Maine. After two years of paying down our credit card debts and improving our credit rating enough so that we could qualify for certain "special programs" for borrowers with excellent credit, we had finally succeeded in buying our very own first home. That is when all of the problems began. We had qualified for a unique loan where 80% of the loan was under a traditional 30-year mortgage at an excellent interest rate - specifically 6.25%. You just can't beat it. However, the catch was this. Since we hadn't had a chance to save up a down payment for the house, GMAC Mortgage was willing to offer us a second mortgage on the house for $42,000 at a variable interest rate. At the time the loan was processed, this interest rate was only 7.5%. After we had moved into our home, I watched with trepidation as Alan Greenspan at the federal reserve gradually continued bumping up interest rates every few months. As I watched, over the course of one year, the feds bumped up rates ¼ point, ¾ points, and on and on until our rate on the variable loan in 2007 had hit over 9.3%. Angry with the Federal Reserve, I started to call around and ask what we could do to get rid of our variable interest loan. However, since we hadn't built up enough equity (in fact, due to the fact that home prices had fallen dramatically in our area since we bought the house), no one could help us. We find ourselves trapped, in an upside down mortgage (the house is now worth much less than we paid for it), and a variable rate loan that we can't afford. The Clinton Solution Below, we will examine Clinton's four-point plan and determine whether or not her plan would really assist other folks, like us, who have been trapped by the allure of the adjustable rate mortgages that have been so popular over the last few years. 1) A New Action to Help Millions of At-Risk Homeowners Restructure their Mortgages and Stay in Their Homes. The Proposition - Senator Clinton wants to extend the reach of the FHA to guarantee restructured mortgages as proposed by Rep. Frank and Sen. Dodd. This action, according to Hillary, would help millions of Americans who could responsibly pay monthly payments, through a restructuring of their mortgages. The approach she supports would essentially allow the government to guarantee affordable, restructured mortgages that would depend on private-sector auction of large mortgage pools. Would it Help? - This solution would prove to be a tremendous influence on overall financial markets. A majority of home-owners who are struggling under the enormous weight of mortgages that simply have interest rates that are too high, would find relief from the very simple restructuring of mortgages that lower the interest rates and may even convert the loans to more reasonable 30 year mortgages with the kind of reasonable payments that responsible homeowners can actually afford. 2) A High-Level Emergency Working Group on Foreclosures to Investigate How to Achieve Broad Restructuring of AT-Risk Mortgages. The Proposition - Clinton is calling for the establishment of an Emergency Working Group on Foreclosures that would report within three weeks on the best way to resolve the current mortgage crisis. The proposed Working Group would be headed by such experts as Alan Greenspan, Paul Volcker, and Bob Rubin. The role of this working group would be to provide an analysis of the effectiveness of the proposed Frank/Dodd legislation. If the legislation is determined to be ineffective, then the group would be tasked with investigating an effective government role through FHA or some other entity as an intermediary purchaser in the case of necessary government intervention. Would it Help? - It could, although the help would be indirect. Such a working group would make sure that the proposal offered in #1 would actually work. If it wouldn't work, then the Working Group would essentially come up with some kind of plan that would allow the government to step in as an intermediary purchaser if mortgages are falling into default and foreclosure. 3) Clarifying Legal Liability for Mortgage Servicers to Help Unfreeze the Mortgage market Proposal - While many people don't realize that mortgage companies are held liable to investors who actually own the mortgage papers, this particular proposal focuses on that aspect of mortgage lending. This is the reason why mortgage companies are resistant to the restructuring of such loans. Senator Clinton proposes to introduce legislation that would ensure that such mortgage companies who do the right thing through helping homeowners keep their homes, as well as meeting the investors needs to avoid risk - would not face legal liability or negative tax consequences. Would it Help? - This is one item that could help those of us struggling under a ridiculously high interest rate. Currently, mortgage lenders are very unwilling to consider even a slight drop in interest rates - or even a minor restructuring of the loan that would reduce the monthly payment to a degree that would make it more affordable. It is very likely that if the legal and tax liabilities are removed from the mortgage lenders, they would be much more willing to talk when customer's call and express that they can not make the current mortgage payments. 4) A New Housing Stimulus Package With at Least $30 Billion for States and Localities to Fight Concentrated Foreclosures Proposal - Senator Clinton proposes emergency housing funds would be designed to be administered quickly to state, local and community groups that work to stem foreclosures through grants provided for: - Acquiring distressed properties, making improvements, and putting them back into productive use. - Offsetting the costs associated with crime and safety in distressed neighborhoods. - Working with homeowners under threat of foreclosure to restructure their mortgages. Would it Help? - This aspect of the four proposals above is one which would not only help individual homeowners, but it would save entire communities from the disastrous effects of foreclosure. Foreclosure can lower property values all around the property that is foreclosed. It can distress entire neighborhoods due to reduced collected property taxes, and can lead to increased crime in the area. If money is directly sent to help communities avoid this fate - it would save all of us who are either facing imminent foreclosure, or live in a community where groups of folks are currently facing that reality. Should these proposals become a reality in the near future, it is likely that it could essentially save us from the current housing crisis. In fact - it could save the entire economy. However - whatever solution is adopted, it would need to be wide in scope, very aggressive, and quickly implemented. The slowly turning wheels of bureaucracy are not acceptable in such a crisis as this one, and empty campaign promises will do nothing to prevent families around the country from losing their homes. These are all valuable answers to the crisis that our country now faces. We can only hope that these campaign promises are sincere, because at face value, they are powerful, important, and effective answers to the crisis that so many American families are facing today in this country. |

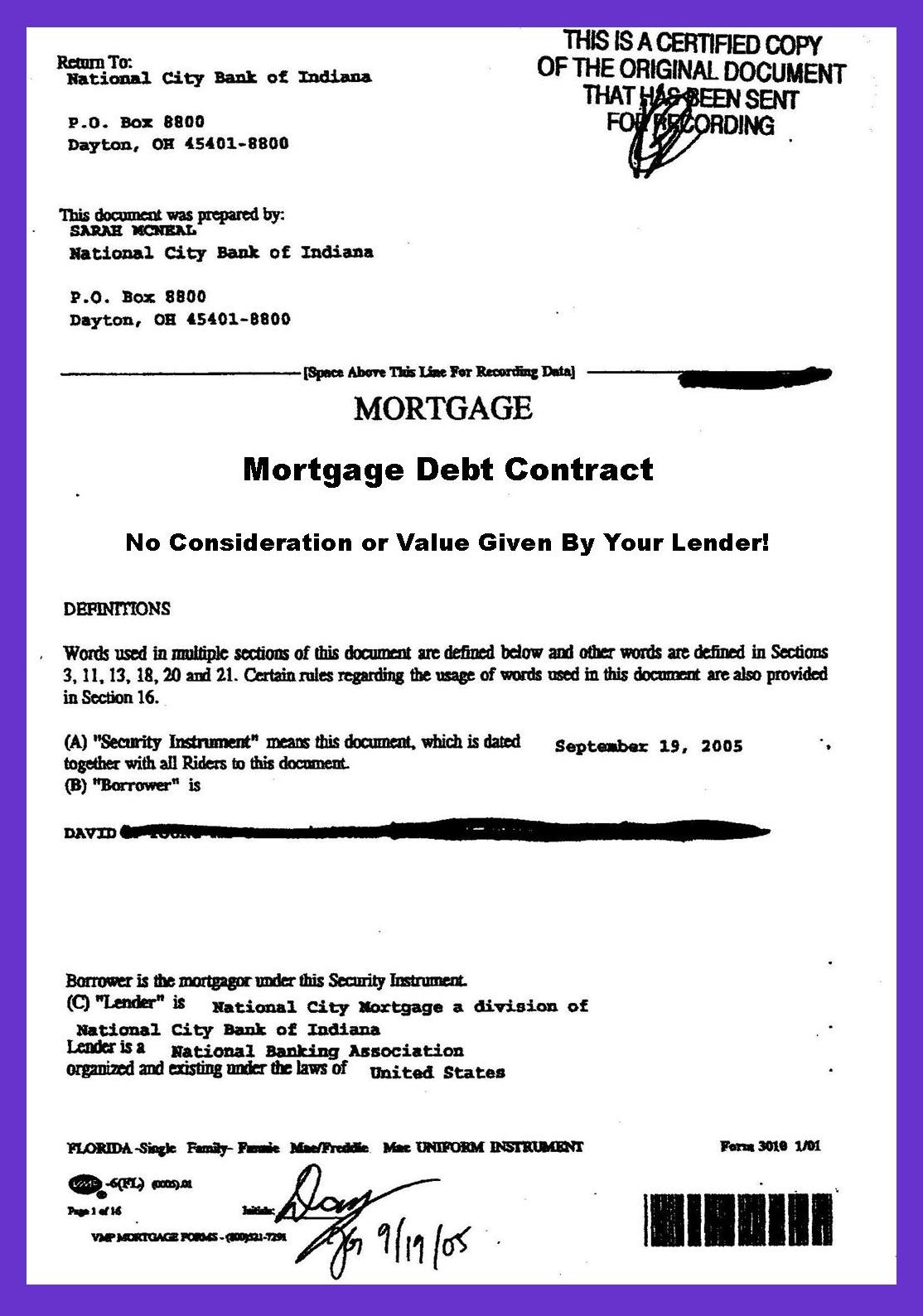

Image of mortgage debts

mortgage debts Image 1

mortgage debts Image 2

mortgage debts Image 3

mortgage debts Image 4

mortgage debts Image 5

Related blog with mortgage debts

- gators911truth.blogspot.com/...do consider debt consolidation. Thus, in what way it works? If you browse the debt consolidation mortgage refinance a slightly generous amount of your debt and the debt consolidation mortgage refinance...

- gakerly.wordpress.com/...minimum of 74% were eligible for tax relief under the guidelines of the Mortgage Debt Relief Act. Co-Founder Chad Ruyle stated that had the Relief Act not...

- daisandassociates.wordpress.com/... Extension For One More Year Of the Mortgage Debt Relief Act! Before leaving office... a one year extension of the Mortgage Forgiveness Debt Relief Act. The extension of this act, which...

- brainiac-conspiracy.typepad.com/my_weblog/...) to have any meaningful impact on our various debt crises (housing, medical ..., ideally---simply refuse to make their mortgage or student loan payments at the same...

- tenthltr2u.wordpress.com/... plan to forgive part of the mortgage debt owed by millions of... say they do not see the mortgage debt overhang primarily at work. Rather, they say...

- pattidudek.typepad.com/pattis_blog/...they’re not going to be solvent even with the amount they receive as forgiveness of mortgage debt,” says Allen

- darrenpujaletblog.wordpress.com/... amount may be taxable.The Mortgage Debt Relief Act of 2007 generally allows...the exception created by the Mortgage Debt Relief Act of 2007 and applies...

- ogdeninsights.blogspot.com/...be ahead for homeowners who are underwater on their homes: \ The Mortgage Debt Relief Act of 2007 is scheduled to expire at the end of the year. The...

- southorangecounty.wordpress.com/Mortgage Debt Forgiveness Preventing Foreclosures...in 2010, according to Amherst. The mortgage servicers cannot forgive debt on loans that are owned...

- livinglies.wordpress.com/...who all agreed that reduction of household debt — and in particular the dubious mortgage debt that Wall Street is using to make more and more profit, is something...

Mortgage Debts - Blog Homepage Results

Credit Card Debt Suspension Insurance Premiums REDUCED by 2000%, IMPROVED Reverse Mortgage Options, INVOLUNTARY Credit Card Default Rights, a NEW STOCK MARKET for Main Street.

Tip and Technique for Debt Restructuring, Mortgage Loand Modification, Mortgage Restructure with creditor. And Debt Consolidation Information.

...and jobs to people to pay or repay a debt or to enable them a little more money...for obtaining a way to repay a loan, mortgage or credit card. Need help and guidance sign in and...

Related Video with mortgage debts

mortgage debts Video 1

mortgage debts Video 2

mortgage debts Video 3