About 'receivables write off'|The Trade Receivables In MaeMode

Financial statement information almost always includes receivables, especially for public companies. Knowing how to classify and account for them in your books will make your statements more legitimate and prevent problems from occurring when you're under audit. While this article offers only the basics, receivables go into great detail which you may need to consult your CPA about. However, you will be alerted to the important points in understanding these accounts. One further point, the formatting of this text wouldn't allow for indentations to make the presentation simpler, so Debit and Credit was added to the proper entries. Different classes of receivables include those from customers and those from employees and shareholders. To make things easier, here we will focus on current receivables, or those that are due within one year. When a company sells a product or service, and the buyer of that product or service cannot pay in full at the time of sale, a receivable is incurred. The company does not receive cash right away, and thus does not debit cash, but accounts receivable. Let's take an example to get you started. Zoop, Inc. sells tiles. On March 10, they sold 5,000 tiles at $2 per tile to Mark. Mark is a longtime customer of Zoop's and can only pay for half the expense at this time. The company agrees to give Mark 30 days to pay the balance. Zoop would record the transaction as follows: Debit--- Accounts receivable, Mark - $5,000 Credit-------------------------------- Sales - $5,000 If Mark pays the balance in 30 days, the company would simply reverse the transaction and record the revenue as follows: Debit--- Cash - $5,000 Credit------ Accounts Receivable, Mark - $5,000 Most of the time, this is what company's record. Occasionally, however, there are problems with obtaining payment. In that case, the company sets up an "allowance for doubtful accounts" account. The accountants need to figure out a percentage of credit sales that historically reflects the amount of payments that were never received. One way to do this is by the percentage of sales method. Let's say Zoop has average annual credit sales of $4,000,000. Accountants at Zoop estimate that 2% of credit sales are never recovered. The computation is as follows: Total credit sales: $4,000,000 Bad debt ratio: 2% of sales Allowance account threshold: 2% x $4 million= $80,000 The resulting entry would be: Debit-- Bad debts expense - $80,000 Credit----- Allowance for doubtful accounts - $80,000 If, from the previous example, Mark was not able to pay the balance, the company would take the loss and expense it. Their new entry for the write-off would look like this: Debit-- Allowance for doubtful accounts - $5,000 Credit------------- Accounts Receivable, Mark - $5,000 This new entry would reduce Zoop's allowance account by $5,000, resulting in a balance of $75,000: Allowance for doubtful accounts $80,000 - uncollectible account $5,000 = $75,000 remaining. As you can see, receivables are quite simple when customers pay the balance on time. The only real complication comes about when companies sell their receivables to other willing buyers, in order to obtain most of the cash in the present. But that is outside the scope of this article, and perhaps will appear in a later one. For now, this basic understanding of receivables will help you with about 90% of transactions. |

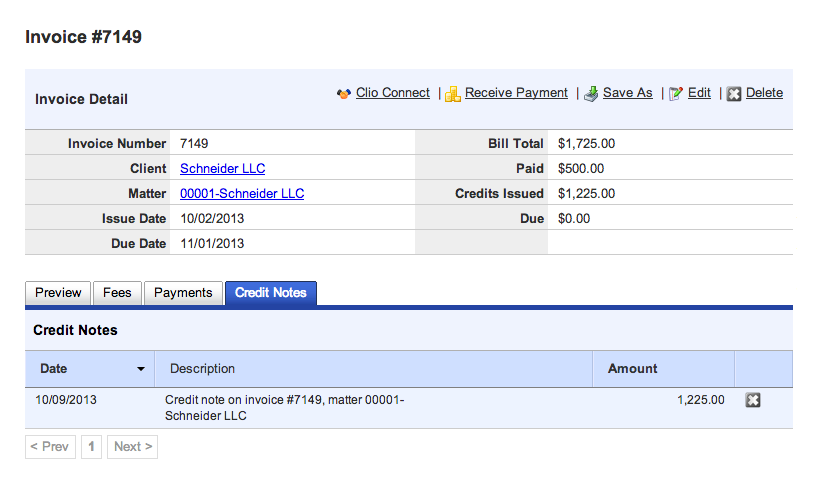

Image of receivables write off

receivables write off Image 1

receivables write off Image 2

receivables write off Image 3

receivables write off Image 4

receivables write off Image 5

Related blog with receivables write off

- smeerp.blogspot.com/...below write off screen which is present in Accounts receivable->AR Periodic Processing->Create write off batches. Once the batch is executed, system...

- greenbriarpictureshows.blogspot.com/...The AFI published this in 1972 to show off projects they’d done since formation... I have remain hypnotic. Lamparski should write a new (very thick) update about what these...

- zengersmag.blogspot.com/...pension liabilities after 2025 — as showing the system “falling off a cliff,” an odd metaphor to use for a development he was arguing...

- quickbooksblog.blogspot.com/...thing to keep strait are your receivables. After all, if you keep sending...give you a starting point. To write off bad debt follow these ...

- dekalbofficersspeak.blogspot.com/...Stogner, where he indicates that a portion of the uncollected revenue should be written-off because it is several years old. You can watch the commissioners...

- healthcarefinancials.wordpress.com/... , Practice Management , Risk Management Tagged: | accounts receivable , ARs

- knoworacle.wordpress.com/...by running the Journal Entries Report. Write-off the invoice balance:DR : Cost of Doing Business (Receivables Activity – may override) CR : AR (from the invoice) Loss...

- arekpinter.wordpress.com/... Accounts: Direct Write-Off Allowance Method Direct Write-Off : Theoretically undesirable: no matching. receivable not stated at net realizable value. not acceptable for financial...

- asoracle.blogspot.com/...Receivables Activity - may override) CR : AR (from the invoice) Write-off the invoice balance: DR : Cost of Doing Business (Receivables Activity - may override) CR : AR (from the invoice) You...

- whereiszemoola.blogspot.com/...issue becomes doubtful, they will have to be written off and given the current size of the receivables, if and when this happen, the losses should...

Related Video with receivables write off

receivables write off Video 1

receivables write off Video 2

receivables write off Video 3

0 개의 댓글:

댓글 쓰기