About 'income to debt'|Kiwi Income Property debt levels should be a worry to investors

Inspect the Car Take the car to a qualified mechanic and have them perform a full inspection. The mechanic should inspect the main features of the car including the engine, transmission, electrical, tires, and overall safety condition. A smog check should also be performed to see if the car meets current air quality standards. Without passing this test, you will not be able to register the car in your name or obtain new plates from your local Department of Motor Vehicles. Should the mechanic find any pertinent issues that need repairing, negotiate with the current owner to pay for them before buying the car. Show Credit Worthiness Obtain a copy of your credit report. You can get a free one by visiting the website freecredreport.com. You are allowed access to a free copy once a year from one of the three reporting bureaus. Since either a loan company or bank will be holding the note on the car, you will need to provide your credit history. The financial institution will also run a credit history report as well. Pertinent items of interest they will be looking at include history of employment, outstanding debts, income-to-debt ratio and your rental/housing arrangement. Based on the information collected, the bank or loan company will then base their decision on said information. Negotiate the loan Payments Negotiate the terms of the loan with the financial institution. The loan company or bank will meet with you in person and discuss the terms such as the interest rate, length of the loan and the estimated monthly payments on the loan. The interest rate you are charged will be based solely on your credit rating. The better your credit rating is the lower the interest rate will be. Agreement to Purchase Write an agreement letter between both the seller and the buyer to purchase the car. Have the agreement c learly state the date of the transaction, the mileage on the car at the time of purchase, date when the loan is due to be paid off, and the transfer of title to the new owner. You can have an attorney draw up the agreement or you can visit lawdepot.com/contracts and download the appropriate agreement. Once both parties are in mutual agreement, each must sign it in front of the notary and have it notarized. Autos http://www.autos.com/car-buying/how-to-take-over-car-payments Car Finder Service http://www.carfinderservice.com/car-advice/how-to-take-over-the-payments-for-a-used-car Take Over Payment http://www.takeoverpayment.com/ |

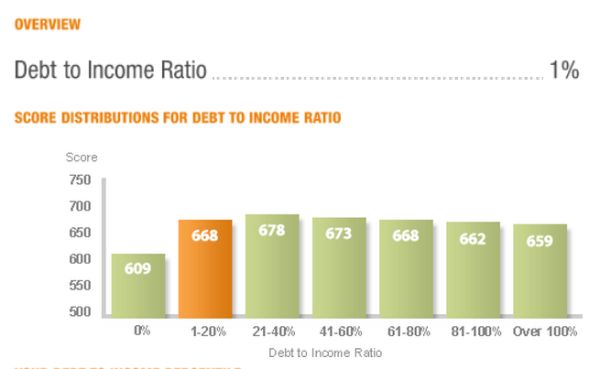

Image of income to debt

income to debt Image 1

income to debt Image 2

income to debt Image 3

income to debt Image 4

income to debt Image 5

Related blog with income to debt

- saskatoonhousingbubble.blogspot.com/...debt burden higher The ratio of debt to personal disposable income, the key measure of where a consumer...since 1992. That is why household debt to income has exploded since...

- shareinvestornz.blogspot.com/...The company has massive debt levels of almost NZ$1...last year and are likely to be worth even less next year as...over-reliance on one property for income - Sylvia Park Shopping...

- eboatloans.wordpress.com/..., and rv loans. If your debt to income ratio is too high, you will not...make your monthly bills easily, your debt to income ratio is 75%!!! This will not qualify...

- ulvog.wordpress.com/...a church loan is the ratio of debt to total income. This calculation looks at the total...fictional financial statements show debt to income less than 3.0. That would meet the test...

- grandterracenews.blogspot.com/... the CITY should have to use for CITY needs. Half of the Cost of the City Manager's Income and Perks come from DEBT FINANCING aka the RDA. There...

- lawprofessors.typepad.com/...organization will use borrowed money to invest in the hedge fund, thus creating the potential for unrelated debt financed income (taxable at normal corporate rates...

- toddballenger.typepad.com/borrow_smart_blog/..., but 40% of Americans now spend 30 - 50%+ of their gross income to service mortgage debt.

- gaslamppost.wordpress.com/... by Rev. Jesse Jackson Sr. not to worry about loading up low income students and first generation... with “too much debt,” because he had it on good...

- kopsaottesalon.blogspot.com/...enough, it would take over 794 years of all the farm income in the United States just to cover our national debt. Politicians need to do something to reverse this...

- jinx-runningscreaming.blogspot.com/...feedback! Pawn a piece of my pride back, by repaying my two-years-old debt to the erstwhile host who, after all, lives less than three miles from my current...

Income To Debt - Blog Homepage Results

This is a blog detailing my climb out of the gargantuan debt I'd accrued even in comparison to my yearly income.

Insider information on how to become a successful professional commercial debt negotiator and earn a Six Figure Income. My turn-key Business Plan System will teach you EVERYTHING you need to know... from ...

Our goal is to remove over $61,000 in debt using passive online income streams. Visit our blog regularly to review our progress.

Related Video with income to debt

income to debt Video 1

income to debt Video 2

income to debt Video 3

0 개의 댓글:

댓글 쓰기