About 'debt creditor'|Can Unsecured Creditors Garnish Wages To Recover A Debt

You know it wasn't too long ago that I was in debt up to my ears and living paycheck to paycheck. All I could think about was my family and how much I wished they could have more. Suffering from a building debt in our current economy is definitely not unheard of. In fact, almost half of all Americans are in severe debt living paycheck to paycheck. You may have asked yourself at least once, "what do I need to do to get out of debt and back on my feet." Well your in luck and I may be able to help. You must remember before you go in and immediately start reducing your debt that this is not overnight and may take several months to a couple years to get you debt free so have patience. I am not going to tell you anything that is not already being done by debt consolidation agencies that charge you money you don't have in order to reduce your debt. The first thing you want to do is sit down with a pad of paper and a pen and start writing down everybody and/or agency you owe money to and the interest rates you are being charged. Don't forget to have your most recent statements in front of you as well to better gather this information. Once you have gathered the necessary information it will be time to call all your creditors and see if you can get the annual interest rates lowered. Some creditors will lower them some will not. NOTE: no matter how annoying the creditors may be it is very important to be polite and considerate. Next, you will want to start balloon payments of your own starting with the debt with the highest interest rate first while paying the minimum payments on all other debt. This is the most important step of all as this is what will get your debt paid quicker. Have you ever seen how much you end up paying a creditor when the interest rates are high? Let me show you what I mean. If you have a credit card that has a balance of $3000 and you have a 19% annual percentage rate (APR) you will pay in one year to that creditor approximately $570 of your own money. Think about it to, if your paying the minimum payment that never seems to drop the balance you are paying this $570 every year. In 5 years this one debt has cost you $2850 of your hard earned money. This balloon payment method with save you thousands in the long run and get your life back on track. Take your debts and line them up with your highest interest rates at the top (no matter what the debt is) and start paying $10 to $20 extra a month on top of the minimum payment and watch the debt start to go away. Once that debt is paid off, CLOSE THE ACCOUNT. You will then take the payment you were making to that creditor and apply it to the minimum payment on the next higher interest rate debt. For example, let's say you were paying off the $3000 debt above and originally the minimum payment was $46. Let's say you were able to afford an additional $20 per month on this debt. Now you are paying $66 a month. You will pay off this debt approximately 2 years faster than what you would have. Once you have paid this debt off you will tack the $66 you were paying onto your next debt minimum payment. So let's say your next debt minimum payment was $10. You will now be paying $76 towards this debt a month. Once you pay off two of you debts using the balloon method your remaining debt will dwindle quickly. So as I said previously, in the beginning you MUST have patience. Something else that helps out a lot is the end of year tax return if you are lucky enough to receive one. Take 50% to 60% of the return you receive and apply it to the debt you are currently trying to pay off. Don't split it among all your debts as this will only dent the balances and not do you any good as the interest will still tack on to the remaining balance. With the remaining 40% to 50% of the return go and buy something or do something for yourself or your family as an incentive for your patience and hard work at lowering your. You should take about 10%, at least, and put it into a savings account that accrues interest as this will pay off in the end. This is not just another article on being debt free, this is real and works very well. I was $33,000 in debt with $2200 in monthly payments just 5 years ago and I only have approximately $3000 debt today with $100 in monthly payments. I challenge you to be debt free and live with no money worries. Take your significant other out on a date or your kids to Disney World. The sky is the limit when your not living paycheck to paycheck. |

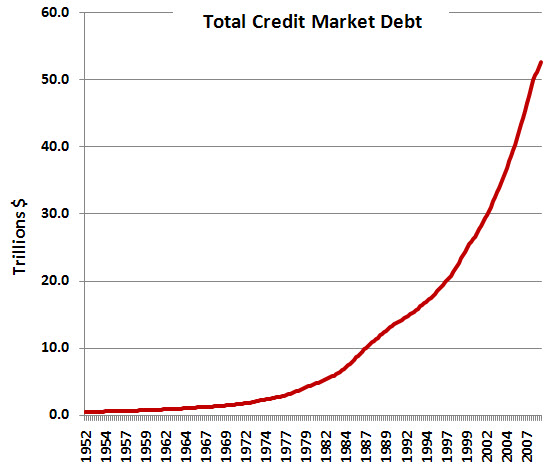

Image of debt creditor

debt creditor Image 1

debt creditor Image 2

debt creditor Image 3

debt creditor Image 4

debt creditor Image 5

Related blog with debt creditor

- www.freecreditcounselingblog.com/...you have it. Keep your cool and good luck. If you want to do more research you can visit: Creditor Debt Help. Yours Truly Steven Ciantro Consumer Advocate American Debt Enders Certified...

- lsolum.typepad.com/...Doctoral College of Law and Economics) has posted Towards a Solution to Odious Debts and Looking at Creditors' Incentives on SSRN. Here is the abstract: Rather than propose a solution...

- nourielroubini.blogspot.com/Nouriel Roubini on Greek-Creditor Debt Talks Jan. 20 (Bloomberg) -- Nouriel...for an accord between Greece and private creditors. He spoke with Bloomberg's Margaret...

- bankruptcywashingtonstate.wordpress.com/What can a creditor do if I default on my debt? October 21, 2011 in Uncategorized | ...If you do not voluntarily pay back your debt, the creditor will proceed with collecting the...

- homesbyjim.wordpress.com/...differance between debt management and settlement: Debt Management, Debt Settlement, Consumer Credit, Debt Relief, Creditors – AARP . Rate this: Share this: StumbleUpon Digg LinkedIn Twitter Facebook Like this: Like Be the...

- easydebtrelief.blogspot.com/...you're asking for lower debt payments or even total debt settlement. Creditors are usually interested in making their money back and...

- creditloanstogo.blogspot.com/Can Unsecured Creditors Garnish Wages To Recover A Debt? Wage garnishment ...pay extrinsic on your debts. The creditors are ...

- dedicatedsolutionsgroup.wordpress.com/... disputed, the creditor must cease collection of the debt until the creditor verifies the debt and provides the debtor or any attorney for the debtor with copies...

- debtcontrolman.wordpress.com/...Man Share this: StumbleUpon Digg Reddit Tags: agreement , borrow , conditions , creditor , debt , fair treatment , force majeure , interest rates , loans , negotiating...

- dedicatedsolutionsgroup.wordpress.com/... disputed, the creditor must cease collection of the debt until the creditor verifies the debt and provides the debtor or any attorney for the debtor with copies...

Debt Creditor - Blog Homepage Results

Tip and Technique for Debt Restructuring, Mortgage Loand Modification, Mortgage Restructure with creditor. And Debt Consolidation Information.

The dos and don'ts of your debt. How to keep what you have! Manage your credit and debt. Protect your assets from creditors. (by The Dean of Debt)

... sleepless nights over debt problems? Are you...the incessant calls of the creditors? If your answer is yes to...

Related Video with debt creditor

debt creditor Video 1

debt creditor Video 2

debt creditor Video 3

0 개의 댓글:

댓글 쓰기